Member-only story

How Airtable Can Thwart Google, Microsoft, and Amazon

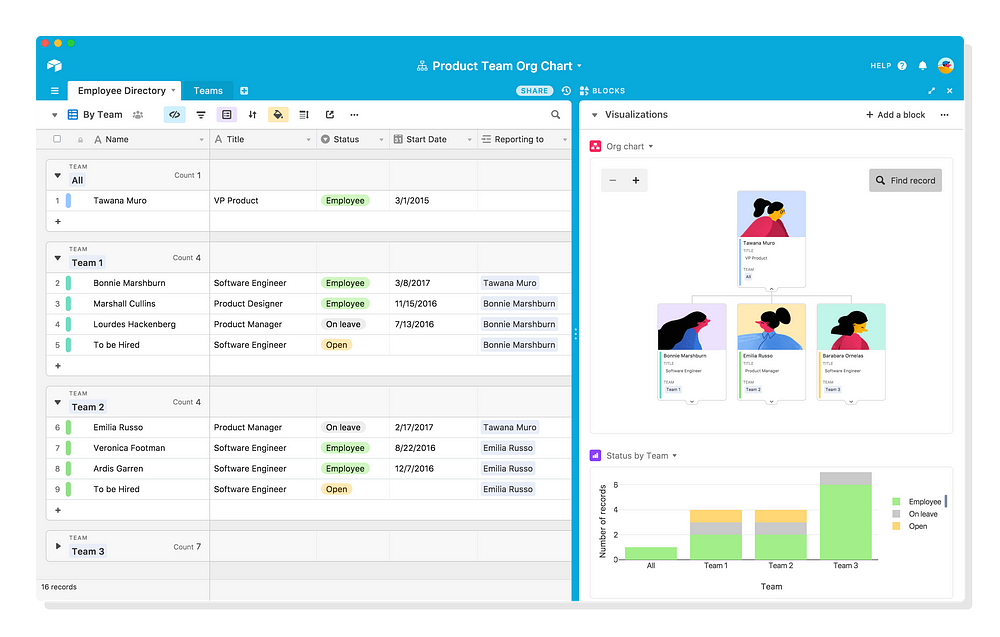

To avoid being crushed by Big Tech rivals, the collaboration and productivity platform can mimic Slack’s strategy

There are around 2 million apps on the iOS App Store, according to Lifewire. The market intelligence firm IDC bets this is just the beginning, estimating that by 2023, across all operating systems, “over 500 million digital apps and services will be developed and deployed using cloud-native approaches.” Citing this statistic in a September 14 blog post, CEO Howie Liu promoted his company Airtable — the workplace collaboration and productivity platform — as a tool that will help create many of these new apps. That same day, Airtable announced it had raised a $185 million Series D round at a $2.6 billion valuation, more than doubling its $1.1 billion valuation in late 2018.

In 2019, there were nearly 24 million software developers in the world — not nearly enough supply to keep up with the demand for these forecasted 500 million apps. Although visual programming interfaces have been around for decades, this discrepancy drives the resurgence of low-code and no-code software: tools that enable people without conventional software development experience to build simple apps using little or no code respectively. No-code application development…