No Mercy / No Malice

Stream On 🍿

Who will win (and lose) the streaming wars?

My NYU colleague professor Adam Alter has conducted research confirming that the most enduring of the senses is smell. Smell can take you back to age five, to that anxiety that sharply arose when your mother was tucking you in. Mom dousing herself in Revlon’s Charlie meant one thing, she and dad were leaving you with a stranger/babysitter. No other sense works as fast as the scent of burnt cashews will take you back to walking along Broadway, feeling inspired after seeing Cats.

My NYU colleague professor Adam Alter has conducted research confirming that the most enduring of the senses is smell. Smell can take you back to age five, to that anxiety that sharply arose when your mother was tucking you in. Mom dousing herself in Revlon’s Charlie meant one thing, she and dad were leaving you with a stranger/babysitter. No other sense works as fast as the scent of burnt cashews will take you back to walking along Broadway, feeling inspired after seeing Cats.

Big tech has decided that original scripted television will foment enduring loyalty across platforms that sell many things. So, for the foreseeable future, the deepest pockets in the world will spend more on scripted television each year than Canada or Australia spend on defense. If Netflix continues to increase its content budget at the same rate, by 2025 Netflix will spend more on Stranger Things, You, The Crown, and other original content than the U.S. spends on food stamps (SNAP).

Who says capitalism isn’t working?

Let’s break down the key players, their strengths and weaknesses, the winners/losers, and make some predictions. For my money the criteria are content, value, distribution (control of purchase/experience), and flywheel (ability to monetize content/loyalty across other business units).

Carpe Stream — Netflix

Netflix, the original gangster, has the largest budget and the best technology. For all the talk about A.I., the only tangible way A.I. has changed my life is the Netflix algorithm. Those endorphins still hit when it figures out I’d like to watch episode six of House of Cards after watching episode five, in 3, 2, 1.

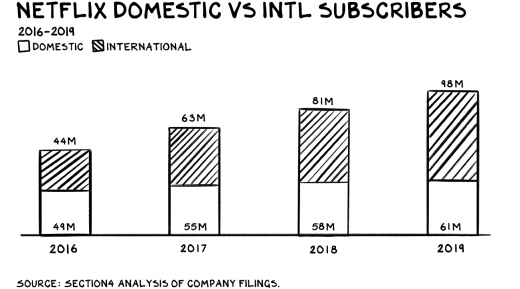

Netflix has first-mover advantage, 159 million subscribers, access to Amazon-like cheap capital, and one of the best leadership teams in tech. Its weakness? A lack of control over their distribution and a pure-play model that has one revenue stream — no flywheel. There are few (i.e, none) firms that have grown much beyond Netflix’s $135 billion in value without control over their distribution or other ways to monetize the enduring scent of media.

At Netflix, content is the main course, and consumers, for now, think of other streaming services as side dishes. Netflix is less vulnerable to the Allied forces invading their shores in force, as it will likely hold its subscriber base in the U.S., and will live or die by international growth.

Midlife Crisis

I believe Amazon’s $6 billion spend on original content is the most expensive hair plugs in history. Put another way, it costs a tech guy who looks like Jeff Bezos $6 billion to take his new girlfriend to the Emmys. To be fair, Fleabag may sell a sh*t-ton more paper towels. It’s another reason, which we didn’t need, to renew Prime. If the worst poker players in the world (Cuomo and De Blasio) hadn’t had their bluff called, Mr. Bezos’s midlife crisis would have cost NY taxpayers another $3 billion. But I digress.

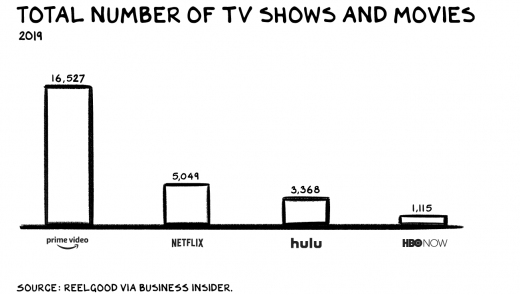

Amazon Prime is number two in the space due to second-mover advantage and access to the cheapest capital in history. Amazon has the most expensive Emmys. Prime Video, despite its investment, has mediocre content (quantity over quality). But the value is there, as it’s bundled with Prime.

Amazon is likely a winner in the streaming wars due to their vertical distribution, via the Fire Stick, and their ability to monetize content across the second most valuable recurring revenue bundle in business, Prime. (Microsoft Office still #1.)

HBO Max = HBO WTF

HBO changed the landscape and will go down in history as one of the greatest collisions of talent and storytelling in media history. However, HBO is now history, as it embarks on a strategy that could best be described as fu*king stupid. HBO built one of the great cultures of creativity in history. Think Disney’s animation studios in the forties, or Athens, Georgia, in the eighties (REM, B-52s), or… okay, I’m reaching, My. Damn. Blog.

Anyway, HBO does so much more… on so much less than other media players because of the secret sauce of their culture, which has continued to attract A-list talent. Junking it up with Big Bang Theory (Warner content) is to take Hermès and decide selling cargo pants is a better business. It isn’t. HBO’s value is not about more, its value is derived from offering less. Less is more… the DNA of any luxury brand.

HBO has the fewest programs of any SVOD, but the best. The green light gets lit less often at HBO, so subscribers are more inclined to try out new programs. HBO Max — moving to a mass strategy — makes no sense. The only thing that will win at the mass level (bumping up against Amazon/Netflix) will be capital they just don’t have. I could cry, seriously cry. The biggest strategy/brand f*ckup of 2020.

This error in judgment coupled with a parent that’s the most indebted in the corporate world will lead to a write-down of AT&T’s acquisition of Time Warner that is second only to Time Warner’s write-down (20 years previous) of AOL. You broke my heart, John Stankey.

HBO Max: great content going to mediocre. Weakest value proposition and good distribution (AT&T and DirecTV). A flywheel effect that hasn’t lived up to the purchase price.

The Empire Finally Strikes Back — Disney+

Pedro Pascal + Baby Yoda = genius. It’s rewarding to welcome the Mouse to the digital age. The Disney+ launch, and its glitches, validated the tech investment at Netflix. However, content does appear to be king, and 10 million sign-ups is validation that being in the business of content creation means you create better content. A flywheel that includes cruise ships, Chewbacca dolls, and a Galaxy’s Edge theme area make Disney+ the most shareholder accretive of the SVOD efforts, as evidenced by the 9% increase in DIS stock ($21 billion) the week of the launch.

Similar to Netflix, the Mouse’s achilles heel is distribution.

Apple TV+

Because I co-host a podcast with Kara Swisher, I’m considered an influencer now and was invited to the premiere of The Morning Show. It was a great event with fabulous people watching a mediocre TV show at… Lincoln Center. Apple TV+ is exactly what you’d expect when a deep-pocketed tech firm hardware starts making TV shows. For the cost of Game of Thrones (each show is $15 million per episode), the viewer gets Murphy Brown. Actually, that’s not fair to Murphy Brown, a great show.

Distribution is off the charts with rails that run through a 1.4 billion strong neighborhood of the globally affluent. On a dollar charged per billion spent on content, Apple TV+ is the best value. Couple this with a flywheel effect that includes the most profitable product ever sold, and it was over before it started, in a good way. Apple TV+ will fail up faster than Adam Neumann.

Peacock

Last mover advantage (none). Good content, good distribution… but does anybody know or care about Peacock?

Quibi

YouTube, except you have to pay for it.

Hulu

A cool trivia question about the tens decade. Will become a sub-brand of Disney+.

Winners

The winners of the streaming wars, as defined by which platforms add the most incremental stakeholder value, will be Disney+, Amazon Prime Video, and Apple TV+. Media has now become a customer acquisition vehicle, vs. a stand-alone business. So, the firms with the most seamless means of speedballing the media crack will win. The media business is now about phones, cruises, and paper towels.

And, as is increasingly the case in our economy, big tech wins. These firms must all spend billions to raise awareness and acquire customers. Spoiler alert: the best place to acquire customers for online media is online media (Facebook and Google). In addition, Apple and Amazon are tollbooths for most/all SVOD, as the app store and Amazon (Fire Stick, Prime) tax or touch most SVOD sign-ups.

Predictions

- Netflix and/or Disney acquires Roku or other distribution

- Roku and Hulu will not remain independent

- Quibi and Peacock underwhelm

- Apple and Disney add $300 billion in market cap combined by launching recurring revenue bundles, “rundles,” with media at the center.

The defense budget of Australia spent on scripted television. The American Dream is alive and well.

Life is so rich,

Scott

P.S. Check out my new podcast and let us know what you think.