The API Economy in Finance: Payoffs of Getting Connected

The API economy can enable a business or organization to transform into a platform.

Google, Salesforce, Netflix, and Instagram all attribute a good fraction of their financial success to application programming interfaces (APIs).

A myriad of other large and small private and public companies have followed in their footsteps since the early 2000s.

Yet one mighty sector has remained wary of the sizzling API economy for nearly a decade: financial services.

Then came the first wave of FinTechs and digital-only banks, empowered by agile microservices architectures, and started dishing out APIs left and right.

The most vocal supporters said: “Hey, why don’t we formalize our API economy initiative and get the regulators on our side too?”

And the officials said: “Sounds good. Let’s try this.” So they greenlighted further “openness” of the once private financial services club.

If you really want to get the gist of things and understand the wider implications of the API economy and the opportunities it presents, this primer is for you.

What is the API economy?

The API economy represents new revenue streams emerging due to tighter integration and connectivity between people, places, apps, data streams, and algorithms.

Essentially, it’s the business of producing value from sharing your data and/or interface elements with other businesses and/or consuming their services.

Let’s take Stripe as an example. Stripe makes a ton of money by letting others embed Stripe payment APIs into their products, whether they’re for local restaurants or multi-million-dollar telecom companies.

Gartner proposes a somewhat wider API economy meaning:

“The API economy is an enabler for turning a business or organization into a platform. Platforms multiply value creation because they enable business ecosystems inside and outside of the enterprise to consummate matches among users and facilitate the creation and/or exchange of goods, services and social currency so that all participants are able to capture value.”

In this economy, a setup works in two ways:

- You can be an API producer like Stripe and rent out your APIs for a price.

- You can be an API consumer and use tech from others to build your own product, akin to building with LEGO bricks.

And if you’re a pro player, you get to do it both ways at once — derive gains from both API consumption and production.

How big is the API banking economy?

Consider Cash App over PayPal.

The API economy in finance is getting pumped up fast as more companies switch to platforms over single-product business models.

Platformable offers the best data on the current size of the API economy in financial services:

Source: Platformable

Europe (and Scandinavia in particular) rather unsurprisingly leads the pack in terms of open banking APIs. For one thing, regulations are favorable. Secondly, the local FinTech market is entering a rebound.

According to Platformable, the use of API banking products in Europe grew by 185% in Q2 2020 alone as over 500 new financial platforms were launched by German regional cooperative and savings banks alone.

Latin America is another hotbed for open banking APIs, with product use surging by 600% in Q2 2021. After the success of local digital-only banks like Belvo and Nubank, both investors and regulators have turned more attention to the space. Brazil, Colombia, Mexico, and Chile, among others, have already released or plan to formalize Open Banking initiatives at the government level.

The US and Canada got to the party late but seem to be catching up this year. A new executive order from the Biden administration will finally allow banking customers to easily port data between institutions. And the Financial Data Exchange (FDX) initiative plans to further push for establishing a market-led financial data sharing API standard in North America.

API-driven financial services are a global trend. Why does this matter?

Because if you are not on board with this trend, you may soon be out of business.

Similar to retail, the financial sector is drifting towards omnichannel operations — an ecosystem where consumers are free to choose between any service to fulfill their immediate needs.

Today, most consumers still have a disjointed experience. They hold several bank accounts with different financial institutions because one offers great savings plans and another has instant free money transfers for checking accounts. Then that’s topped with several FinTech apps — for, say, investing, personal finance management, and credit score tracking.

But those FinTech apps, once complementary, are now secured a front-row spot with consumers. Their offerings have grown more mature, covering a wider spectrum of financial needs customers have at different life stages.

For instance:

- SoFi used to specialize in student loan refinancing. Now they also have investing tools, insurance products, checking and savings accounts, and most recently a cashback credit card. Pretty close to a standard bank.

- Atom Bank recently added a collection of mortgage, personal, and business lending products to its portfolio to secure a bigger market share with maturing Millennial audiences.

- Cash App went from a Venmo competitor to an early-stage digital-only bank, offering access to no-fee checking accounts, debit cards, and crypto investing.

If you didn’t notice how we got here, that is the beauty of open banking and financial services APIs in action — you can deploy new revenue-generating features blazingly fast.

APIs Build Trust, Commerce, and Connection — In Any Direction

To better understand the API economy, let’s look at the key players.

First, we have FinTechs who use each other’s APIs and Banking as a Service (BaaS) products to cross-stitch their services.

Then there are non-tech players moving onto the financial turf. Think of Uber launching a wallet service for drivers. Or Instagram cautiously rolling out in-app payments and checkout for selected shops.

Finally, there are traditional banks and financial institutions looking at this market redistribution and wondering where they will fit in.

If you are in the latter category, you have two options for API monetization:

- Banking as a platform — You can augment your customer product portfolio via partners’ financial APIs to move into new product verticals, expand into new markets, or re-engage customers with upsells and cross-sells. This route works well for banks with an established customer base who want to retain consumers as well as for challenger banks looking to grow fast.

- Banking as a Service (BaaS) — You can distribute some of your core financial services as APIs for others to consume. Payments, loan underwriting, savings, and credit products are just several of the things you can offer via an API. This option works best for digitally mature banks with a modular technical architecture and strong operational processes.

How different banks monetize their APIs

Source: Aite Novarica Group

But such a transition to an API-first economy requires a formal API strategy for mapping how you will manage the new ecosystem of independent products.

And of course, it’s a technologically complex shift.

You’ve probably heard some spooky stories about a software architect who suggested modernizing a legacy backend banking system and was never heard from again.

No one wants to fiddle with the core. It’s sort of a taboo.

But then again, no one says you need to rip out and replace what you have.

There are alternative, less invasive approaches. You can examine your core services bit by bit to determine the lowest hanging fruits — individual processes, data repositories, or systems you can safely segregate from the rest. Then you can repackage them into modular, reusable software components that can be distributed as APIs.

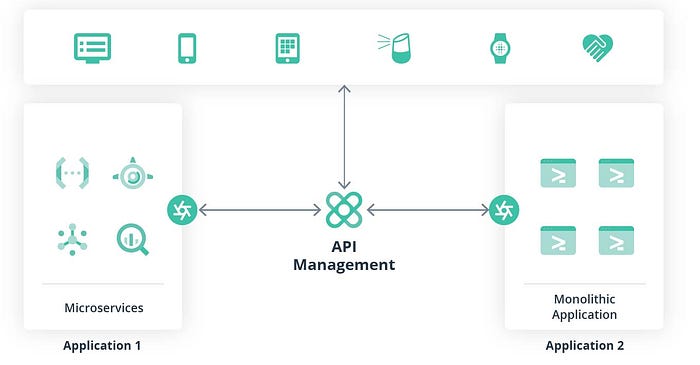

Or you can place an API abstraction layer atop your legacy system to enable data exchanges between it and apps built on a newer microservices architecture. Essentially, such a layer will transport data between services and enable both internal and external exchanges.

If you sort out the above, your new banking APIs will pay off through:

- Better internal system integrations. Using APIs, you can retrieve and combine data assets and functionality from different systems. Then you can “paste” these assets and functionality into other systems to ensure interoperability (even if the systems were never meant to work together by design). That’s a big issue, in fact. According to MuleSoft’s 2021 Connectivity Report, IT teams spend over a third of their time on integration projects. Subsequently, custom integrations cost large enterprises an average of $3.5 million in annual labor costs.

- Reusability. Built once and invoked countless times, APIs allow you to combine and rehash data and functionality for endless use cases at almost no extra cost per use. As a result, labor costs go down while staff productivity increases.

- Shift to demand-side thinking. Traditionally, financial companies were focused on supplying as many customers as possible with available services. The API economy enabled companies from other domains to build a scalable digital asset once and then amass demand for it. As a net producer, you can attract extra revenue by extending your financial services API to new parties: retailers, restaurateurs, auto manufacturers — anyone dealing with money, really. As an API consumer, you can quickly jump on emerging market opportunities to retain a competitive position.

Who’s Cashing In? API Economy Examples in Finance

As of last year, financial companies were responsible for just 5% of API traffic generated by Apigee users.

But users in the financial services industry grew API traffic by more than 125% in 2020 — well ahead of users in any other industry. Clearly, something is brewing in the Open Finance space.

What exactly? I’ve got several hunches.

FinTechs Turning into BaaS Players

Wise (formerly TransferWise) was one of the first players to take a dual approach to scaling:

- Wise has a popular B2B and B2C product — virtual bank accounts with low-cost cross-border money transfers.

- They also have a BaaS partnership vector — renting out their APIs to digital-first banks, FinTechs, ecommerce companies, and other financial players including N26, Monzo, and Bunq.

This strategy works for them. Wise has reported profitability for four years straight and has seen a 43% increase in revenue since 2020 — a year when their profits jumped by 70% compared to 2019.

Tink, a Sweden-based open banking platform, assumed a similar position of supplier, offering a comprehensive portfolio of API-based products, bridging 3,400+ banks in 18 countries. In several years, they managed to approach over 250 million bank customers across Europe.

And that likely drew Visa’s attention. In summer 2021, the card issuer announced they were acquiring Tink for $2.1 billion after Tink’s deal with Plaid was blocked by US regulators.

Incumbents Succeeding with Scaled BaaS

As for traditional banks, OCBC Bank Singapore has comfortably settled into the BaaS role. Their open banking API platform has been up and running since 2016. And they have reaped quite a few rewards. Jointly with the Singaporean government, the bank has:

- Implemented a host of embedded finance solutions for the education, energy, government, and insurance sectors to streamline KYC and payments

- Digitized the pension withdrawal process for the locals so that Singaporeans can withdraw their pensions in a couple of hours instead of five to ten days

- Helped a vending machine provider add cashless payment options

- Provided a payment API to a parking company for streamlining parking payments

The German Solarisbank also entices corporate partners with access to a high-performing API-based BaaS platform and a full German banking license, which supports operations in 30 EEA countries. Their API strategy focuses on providing customers an all-in-one, white-label solution featuring:

- KYC and identity verification

- Full banking accounts and sub-accounts

- Branded payment cards

- Digital consumer loans

- A crypto custody solution

- And more

Already valued at $1.65 billion, Solarisbank plans to further scale its API offerings through the recent acquisition of Contis — another European BaaS platform.

Digitally Mature Banks Focusing on Banking as a Platform

JPMorgan Chase seems to be the biggest defender of this hill.

As Jeremy Balkin, Head of FinTech & Innovation, proclaimed at a recent conference:

“We’re the bank of choice for fintech partnerships because J.P. Morgan is to payments what Amazon Web Services is to cloud and the internet.”

Unlike other incumbents, JPMorgan Chase is assessing FinTechs from an operational integration perspective rather than strictly an investment or M&A perspective (though that’s happening too).

As part of their Financial Solutions Lab, the bank has worked with some 40 financial technology companies. Some of their current tech partnerships are with:

- AccessFintech on improving transparency in trading

- BillDesk to improve statutory and utility payments for Indian customers

- Thought Machine for rapidly entering the UK market

At the same time, JPMorgan continues to explain its open banking API portal and is onboarding new API users. So yeah, they’re playing the game both ways.

Overall, consumption-oriented partnerships between US banks and FinTechs are rather common. According to Cornerstone Advisors, 45% of US banks and credit unions had some partnership with a FinTech and saw good results:

Source: Cornerstone Advisors

Yet just a handful of bank–FinTech partnerships are scaled post-pilot. How come? Incumbents are not as technologically advanced and nimble as FinTechs. Many have a legacy core that restricts the ability to integrate new technologies at scale.

And this brings us back to the core (pun intended) issue — in order to profit from BaaS and the open banking movement, you’ll have to get your core in better shape.

Banking APIs: Perils and Payoffs

You don’t need to crack your core open to profit from the API economy and open banking.

But you should think about how you can establish better connections and integrations between core services and internal or external systems.

That’s the tricky part, sure. Nine in ten businesses say that integration challenges block them from delivering on different digital transformation initiatives.

But it’s a feasible task other banks have managed to pull off. And so can you.

To sign off, here are some API questions to think about:

- What types of internal APIs can we fetch to improve connectivity between different banking products?

- Could an API abstraction layer help connect disparate systems?

- Which services can we distribute externally to attract extra revenue?

- Who is going to be in charge of building those integrations — internal teams or a competent integration technology partner?