No Mercy/No Malice

Unreal Estate

The American dream of homeownership has become a hallucination — in the metaverse

The shifting tectonic plates that inspire earthquakes in the markets are interest rates. And for the entirety of Gen Z’s lifetime, they’ve laid still at record lows. In the 1980s, consumers garnered 10% interest on a CD. That’s a “certificate of deposit” for anyone under 30. For anybody 40 to 60 it’s still a “compact disc.” But I digress.

It’s the boring things that make money — software, insurance — and/or kill you. Lawnmowers kill 90 Americans each year, vs. 10 people killed by sharks globally. Interest rates got their close up in Die Hard (1988), in which Hans Gruber plans to fake his own death and murder dozens of people so he can steal Nakatomi Corporation’s interest-bearing bonds. “By the time they work out what went wrong,” says the villain, played by Alan Rickman, “we’ll be sitting on a beach, earning 20%.”

Scant chance of that line getting written today. Bond yields are at all-time lows, a quarter what they were in the 1980s, and “savings” accounts offer comically low “interest rates” that begin with “point oh” and get worse from there. Low interest rates make fixed income investments less appealing and drive up asset values via cheap leverage. The S&P 500’s Shiller P/E ratio, a respected gauge of the relative price of U.S. equities, is flirting with an all-time high.

The American dream of homeownership has become a hallucination — the apparent perception of something not present. Housing, already on a 12-year tear, has now gained the chaser of a pandemic that made everyone’s home feel unbearably small and shabby. Eight out of 10 urban areas in America registered average home price increases of more than 10% in 2021. Fifty years ago, the average home cost two years of the average American household’s income. Today it costs four.

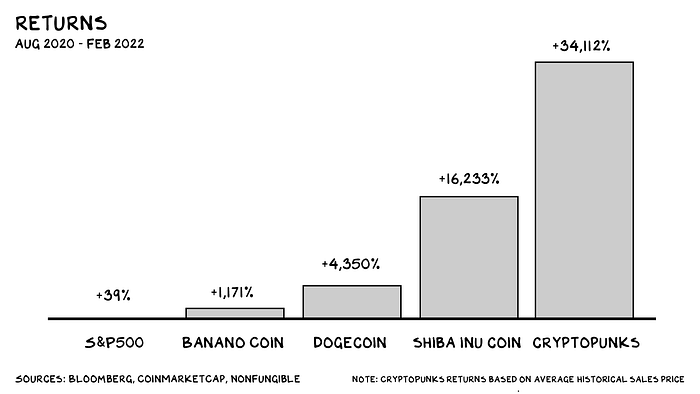

All of which raises a significant question: Where should people put their money? Typically, crises offer buying opportunities for the next generation, as they come into their prime earning years in the wake of a reset. Just as earthquakes relieve geological pressure, decreased asset values are a societal release, birthing a key component of any healthy economy: churn. But this time, our boomer-dominated government employed Covid-19 as cloud cover to protect and extend the wealth of the already rich. Suppressing volatility protects the incumbents; for the first time in U.S. history, a 30-year-old is not doing as well as his/her parents at 30. The result? Young people are creating their own asset classes and volatility. In 2021, these forces manifested in crypto and meme stocks, which offered a mix of volatility, a halo of technology, and a lively cast of aggressive carnival barkers (i.e. evangelists).

But established crypto assets have been bid up, and trade correlated to the stock market. Across the street, the meme-stock trade is unwinding as investors realize they’re not investing in a movement, but a theater chain. It feels as if the era of outsized returns is drawing to a close. However, as Yoda said, there is another. I believe 2022 will bring increased attention, and potentially asymmetric upside to … virtual real estate.

Metastate

Virtual real estate is simple: plots of land in a digital world (i.e. the metaverse) whose value is determined by factors similar to those that drive the value of physical real estate — namely, how big/cool/developed/proximate to other cool people/events they are. In a virtual platform like Sandbox you can buy a beachfront property, or something next to the mall, or something next to the … Warner Music Group headquarters?

Once you own it, it’s yours and leverages the only utility I can discern from the blockchain — a ledger that keeps awesome records. You can develop the real estate, rent it out, have friends over, host parties, open a store or a (virtual) theme park, whatever you want. You just can’t … live there.

Untethered

Why do we think metaverse real estate could be the Gamestop of 2022? Answer: Brand. The mythology of real estate is that its value never goes down, and ownership makes you more responsible and attractive to potential mates. Seventy percent of single women in China say if you don’t have a deed, you’re not a viable mate.

Just as Robinhood fomented a myth that staring at a day-trading app is investing or learning vs. gambling, metaverse real estate combines the heavy, comfortable blanket of a boring asset class with the memetastic growth narrative of crypto. Nitro, meet Glycerin.

Money is pouring in, and a flood could follow. Virtual real estate sales exceeded $500 million in 2021. Analysts project that number will double in 2022. A plot of land on Sandbox was recently purchased for $450,000, as it meant … being meta-neighbors with Snoop Dogg. There’s also commercial real estate: Luxury designer Philipp Plein purchased a property on Decentraland for $1.4 million; it will soon become Plein Plaza. And dedicated real estate development: Metaverse real estate firm Republic Realm recently made the largest virtual land purchase in history — $4.3 million.

The upside defies projection — 5x, 10x, 20x? The innovation in web3 assets is that they aren’t benchmarked against any tangible revenues, much less profits. Moving in deep space, void of any giant astrophysical objects, neither time nor relative size/valuation holds any meaning. Instead of downers such as manufacturing, human customers, or anything producing reliable cash flow, this asset class offers the love of credentialed, persistent, and rabid supporters. They recognize the story as the book, not any actual words inside of it.

Similar to crypto, virtual real estate will be awash in pump-and-dumps and artificial inflation. Crypto allows you to operate multiple wallets: What’s to stop you from buying a property, selling it to yourself a dozen times at spiraling valuations, hiring a PR agent to place breathless stories in the press, and then selling it for 5,000 times what you originally paid? BTW, nothing in the system stops you from doing this. Indeed, the anonymity of blockchain encourages it: The most expensive art sale in history was a $532 million NFT that the owner sold to … themself.

The Wild West gestalt of virtual real estate will likely attract more users than it will repel. As in gambling, the odds don’t need to be in your favor to make it worth it, as the upside could be enormous.

OK, but what’s the fundamental value? Pass. There’s no way to know, and it might be zero. [Editor’s Note: It’s probably zero.] When the molly wears off, we may perceive valuations untethered from reality by orders of magnitude. Or we could all look back and claim we “knew this technology would be enduring.” What if it’s 1950, and I’m offering you a chance to buy the Glendenning family farm for $20 an acre?

And why not? Metaverse or not, we live more of our lives virtually every year — we have more conversations on Twitter, more meetings on Zoom. Sex and rock ’n’ roll are increasingly online. (Now, if only they could fit drugs down those tubes …) Don’t we want a place to call home? Fewer people can even afford a starter home on terra firma today, why not a palace in Decentraland? MetaWeWork, anyone? (Prediction: Whatever Adam Neumann is up to buying $1 billion worth of luxury apartments, it’s going to involve NFTs and the metaverse.)

Third Life

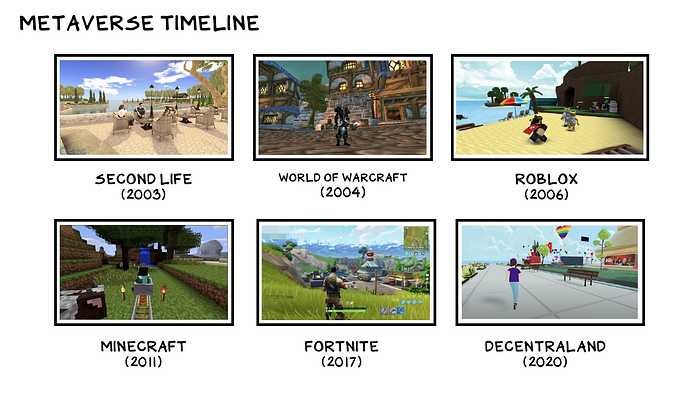

There is precedent for this. In 2006, Ailin Graef (nom de meta: Anshe Chung) became a millionaire developing real estate properties on a virtual platform called Second Life. She soon got a profile in BusinessWeek and became the face of economic opportunity in the digital age. Perhaps it was possible to create real value in a virtual world.

By 2007, Second Life’s GDP was larger than those of several small countries. It had a “population” (metaspeak for monthly users) of nearly 2 million. More than $3 billion was spent on in-game transactions within a decade. But then it faltered. There wasn’t much to do in Second Life, once the thrill of customizing your avatar and walking awkwardly around a cartoon landscape wore off. It required more powerful computers and higher bandwidth than most people had access to at the time. Security was feeble; vandals and griefers proliferated. Several competing virtual worlds entered the fold, splintering the already limited community. The value Second Life promised was only real if enough people believed in it. In 2006, it was the predominant virtual world — and we all believed in it. Until we didn’t.

1%

That’s how much of my net worth I’m thinking of putting into virtual real estate, because that’s how much I’m willing to lose. If I were 25, I might invest 10% of my investment capital — an amount I could afford to see go to zero. Let’s be clear: As a standalone investment, this is gambling. But allocating a fraction of your portfolio to the crazy volatile shit that may offer asymmetric upside (i.e., an outsized return) is less irrational than it sounds.

When you get older, real estate becomes the hippocampus of your brain, where memories reside. I remember the two-bedroom 1,100-square-foot apartment in Tarzana I grew up in. I can see myself under my NFL bedspread in the middle of the night, when my nosebleeds wouldn’t stop and my mom would comfort me with math problems.

I remember the entryway in the coop in New York City my dog ruined, so excited when I came home she couldn’t control her bladder. Our home now is alive in the a.m. with one boy claiming he’s too sick to go to school and the other waiting in front of the door with a backpack that looks like it’s wearing him. In the future I’ll remember how quiet the house was, in the middle of the day, without the boys. I’ll remember feeling helpless, knowing a relentless quiet was coming, when they’d leave and find their own real estate.

Life is so rich,

P.S. Data isn’t the future, it’s the present. If you aren’t using it in your role, you’re probably missing out on opportunities for growth. Sign up for the Data & Analytics Essentials Sprint with industry titan Tom Davenport now.