Member-only story

NUMBER CRUNCH

Why GameStop’s Stock Price Is Going Bonkers

Redditors are playing games with short sellers

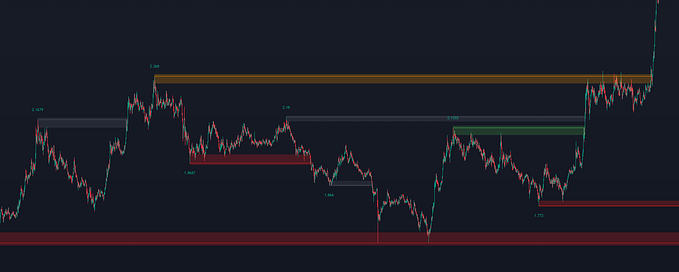

2,200%: That’s roughly how much the share price of video game retail chain GameStop ($GME) has increased over the last nine months. Ars Technica noted that GameStop shares were already up 1,500% on Tuesday from a low of $2.80 in April, but that was before the stock soared to dizzying heights on Friday, crossing the $79 mark at its peak and closing at $65.

If you find it absurd that there’s high investor demand for a company that largely relies on selling digital products in physical locations that are mostly situated in malls, which have themselves been hammered during the pandemic, you wouldn’t be alone.

GameStop shares have been caught in something called a short squeeze: Short sellers like Citron Research, taking note of the obvious reasons why GameStop might be in the wrong business especially during a pandemic, have shorted the stock. But when news broke last week that the founder of pet-food company Chewy was joining GameStop’s board of directors, retail investors began to buy shares on apps like Robinhood, causing GameStop’s share price to surge by more than 93% in a single day. That surge forced short sellers to buy stock at the higher price to cover their positions and further inflated…